The effects of wildfire on access to and affordability of homeowners’ insurance have become an increasing concern in recent years. In Arizona, such concerns have prompted formation of the Resiliency and Mitigation Council through the Department of Insurance and Financial Institutions to investigate this issue. At the national level, recent data releases shed some light on trends in homeowners’ insurance access and how they relate to risk and incidence of natural disasters. This bulletin presents these newly available data for Arizona, comparing homeowners’ policy non-renewals over time to wildfire activity. While the data cannot be used to causally link wildfire and loss of homeowners’ insurance access, they do reveal trends suggesting a strong correlation in areas of the state.

Background

In 2023, amid rising concern around a growing trend of homeowners’ insurance non-renewals in the wake of natural disasters across the country, the U.S. Senate Budget committee began an investigation into the state of the homeowners’ insurance market in the U.S. This included a call to insurers to provide the number of policies not renewed annually in each county and the percentage of total policies this represented for 2018 to 2023. A total of 23 companies provided data, representing an estimated 65% of the U.S. “Homeowners Multiple Peril” market (Senate Budget Committee, 2024). Data were made available for all counties in Arizona. Around the same time, the U.S. Department of the Treasury’s Federal Insurance Office (FIO) and the National Association of Insurance Commissioners (NAIC) issued a Property and Casualty Market Intelligence (PCMI) Data Call. Over 330 companies provided data, representing roughly 80% of homeowners insurance HO-3 and HO-51 policy premiums nationally (U.S. Department of the Treasury, 2025). These data were available at the ZIP Code-level for the years 2018 to 2022, excluding zip codes with fewer than 10 insurers or 50 policies in a given year.

Homeowners’ insurance is generally required to obtain a mortgage. If a prospective buyer is unable to find insurance for a particular property, they may be unable to purchase the property using a mortgage lender. If an existing owner is dropped by their insurer, they may be forced to purchase insurance from an insurer of last resort, typically at much higher rates. Homeowners’ insurance may be either cancelled or non-renewed (Insurance Information Institute, 2025). Cancellation can occur due to non-payment or due to misrepresentations when originally applying for coverage. Non-renewal, on the other hand, can occur for a number of reasons. If a homeowner switches insurance companies, this can lead to a non-renewal of the policy. Non-renewal may also occur due to decisions by the insurer regarding risk for a particular community or property. The data on non-renewals must therefore be interpreted with some caution as the underlying reasons for non-renewals have not been included with the data. Nonetheless, correlations between fire activity and non-renewals appear in some instances. To explore trends in insurance non-renewals in Arizona, this analysis presents data from the Senate Budget Committee report and the PCMI Data along with estimated annual burned acreage statewide and by county2 (USFS MTBS, 2025; NIFC, 2025).

Generally, homeowners’ insurance premiums have been rising, particularly since 2023 (Figure 1). Homeowners’ insurance rates, indexed to 2014 values, are in the blue line. Much of this increase can be attributed to increases in property values and the cost of construction, which means that if a property is damaged or destroyed, it costs more to repair or replace it (Arizona Department of Insurance & Financial Institutions, 2025). The orange line shows the price of inputs to single family residential construction, also indexed to 2014 prices.

Nonetheless, the severity and frequency of natural disasters is increasing, and this has contributed to increases in homeowners’ insurance rates in Arizona (Arizona Department of Insurance and Financial Institutions, 2025). Increasing wildfire risk, driven in-part by incursion of development into areas of the wildland urban interface (WUI), has led to non-renewals as well. The WUI is the area where human development meets or intermingles with undeveloped, vegetated land, and is typically characterized by high wildfire risk to structures.

1HO-3 and HO-5 policies are the most common type of homeowners’ insurance policies. HO-3 policies provide comprehensive coverage for a home’s structure. HO-5 policies provide comprehensive coverage for a home’s structure and the homeowner’s personal belongings.

2USGS MTBS data provide fire scar perimeters for fires over 1,000 acres. These can be used to estimate county-level acreage burned by year, but do not include fires under 1,000 acres. Therefore, state totals from MTBS statistics will not sum to state totals from NIFC statistics.

Findings

Nationally, areas with the highest non-renewal rates were coastal counties and low-lying delta counties, as well as counties with relatively high wildfire risk. Arizona is at relatively high risk of drought, heat waves, and wildfires (FEMA, 2025). Wildfire is considered the largest peril for Arizona and the Southwest (U.S. Department of the Treasury, 2025). Though Arizona’s non-renewal rates are low compared with other states in the country (0.8% in 2023 versus 2.99 in Florida or 1.72% in California), some Arizona counties had non-renewal rates as high as 4.8% in single years (Senate Budget Committee, 2024). Table 1 presents county-level non-renewal rates as reported in the Senate Budget Committee data for 2018 to 2023. These percentages represent the number of homeowners insurance policies that were not renewed divided by the number of policies in force in that county.

| COUNTY | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|

| APACHE | 0.9% | 0.9% | 0.5% | 0.8% | 1.2% | 1.1% |

| COCHISE | 1.3% | 0.9% | 0.6% | 0.7% | 0.8% | 0.9% |

| COCONINO | 1.0% | 0.6% | 0.6% | 0.8% | 2.7% | 1.0% |

| GILA | 0.9% | 0.7% | 0.6% | 1.0% | 2.5% | 1.3% |

| GRAHAM | 1.4% | 1.2% | 0.7% | 0.9% | 1.0% | 0.9% |

| GREENLEE | 1.0% | 0.3% | 1.0% | 2.1% | 0.7% | 1.1% |

| LA PAZ | 0.6% | 0.7% | 0.3% | 0.4% | 0.4% | 0.4% |

| MARICOPA | 1.2% | 0.7% | 0.6% | 0.6% | 0.7% | 0.8% |

| MOHAVE | 1.1% | 0.6% | 0.5% | 0.5% | 0.6% | 0.7% |

| NAVAJO | 0.9% | 0.6% | 0.5% | 1.1% | 4.8% | 0.9% |

| PIMA | 1.3% | 0.7% | 0.7% | 0.6% | 0.6% | 0.9% |

| PINAL | 1.1% | 0.7% | 0.7% | 0.7% | 0.7% | 0.7% |

| SANTA CRUZ | 1.1% | 0.8% | 0.8% | 0.9% | 0.8% | 1.0% |

| YAVAPAI | 1.3% | 0.7% | 0.5% | 0.7% | 0.8% | 0.9% |

| YUMA | 1.0% | 0.6% | 0.5% | 0.5% | 0.6% | 0.6% |

| ARIZONA | 1.2% | 0.7% | 0.6% | 0.6% | 0.8% | 0.8% |

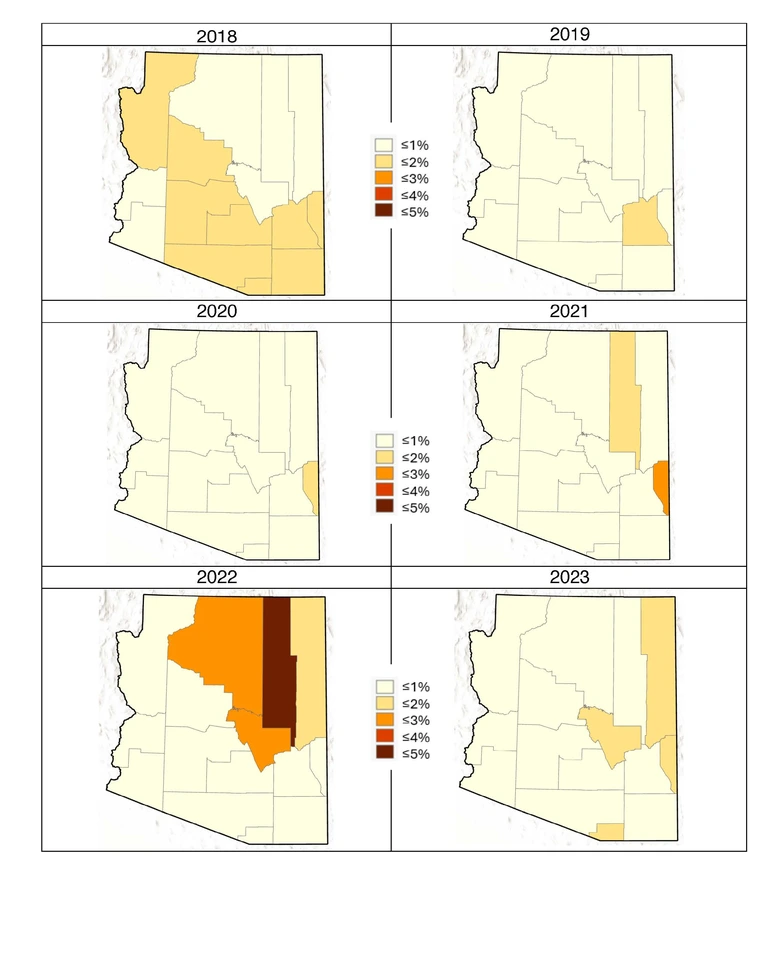

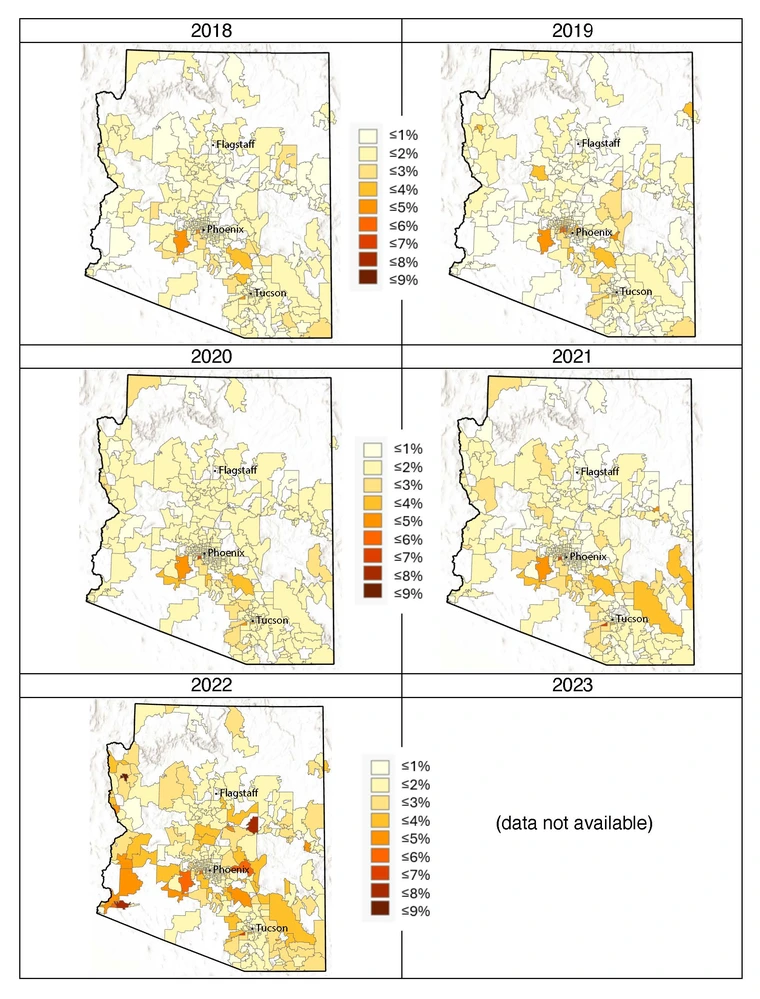

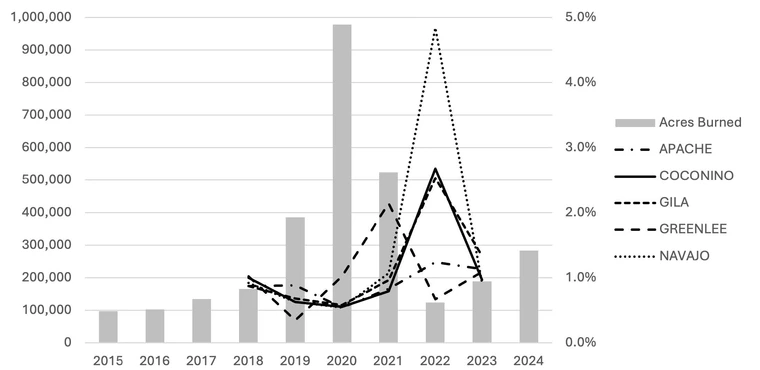

Figure 2 presents homeowners’ insurance non-renewal rates by Arizona county from 2018 to 2023. Non-renewal rates peak in 2022 in counties in the northeast corner of state. These are counties that have been heavily affected by fires in recent years. Figure 3 presents non-renewal rates by zip code. Again, we see a noticeable increase in nonrenewal rates in 2022. Many of these are zip codes in the wildland urban interface.

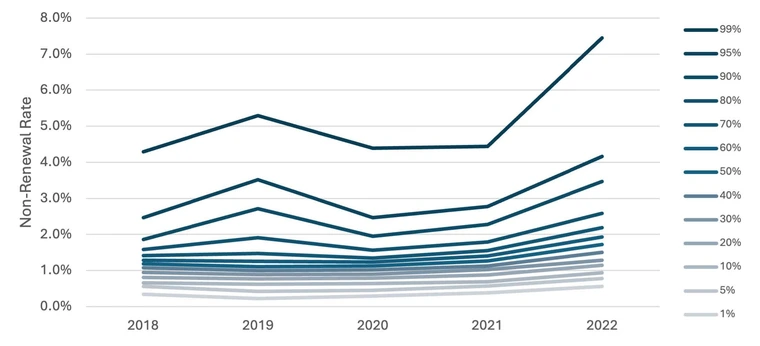

To further explore trends in non-renewal rates, we can categorize individual zip codes by how they rank compared to other zip codes. To do this, we can rank zip codes by their percentile. For example, if 100 zip codes were ranked by their non-renewal rates from lowest to highest, a zip code at the 99th percentile would have a non-renewal rate higher than 99 other zip codes. At the 50th percentile, half of zip codes (50) have a non-renewal rate lower than that zip code. A visual inspection of zip code-level non-renewal rates by percentile from 2018 to 2022 reveals a general increasing pattern over the time period, with the most dramatic increases occurring in the top 20% of zip codes (80th percentile and above). This suggests that overall changes in non-renewal rates may be driven primarily by the highest-risk areas (Figure 4). The zip codes with the highest non-renewal rates each year (in the highest percentiles) are scattered throughout the state (Figure 3) but include areas in high-risk areas of northern and eastern Arizona, as well as areas recently impacted by large fires. Nonetheless, increasing trends over the available years reveal small increases even among zip codes at the lower percentiles of non-renewal rates.

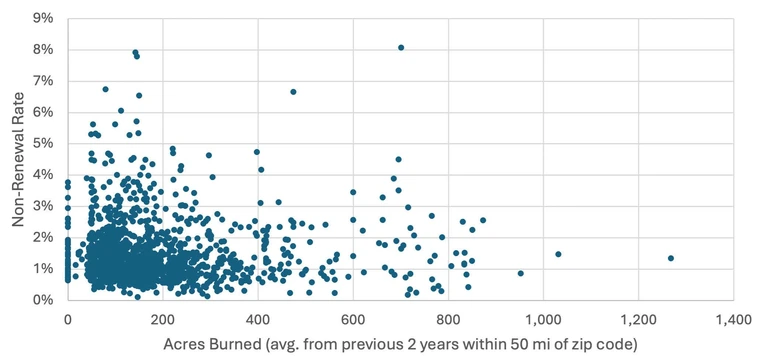

The same information can be visualized by individual zip codes and years, comparing zip-code non-renewal rates to the average acreage burned over the previous two years within 50 miles of each zip code (Figure 5). For example, a data point for non-renewal for a particular zip code in 2020 is plotted against the average annual acreage burned within 50 miles of that zip code between 2018 and 2019. Most zip codes are clustered at low average acreage burned values and low non-renewal rates. There are some instances of zip codes with high non-renewal rates and low average acreage burned. These non-renewals may be occurring due to other reasons, whether natural hazards or not. They may also be driven by assessed risk levels as opposed to recent fire activity in close proximity.

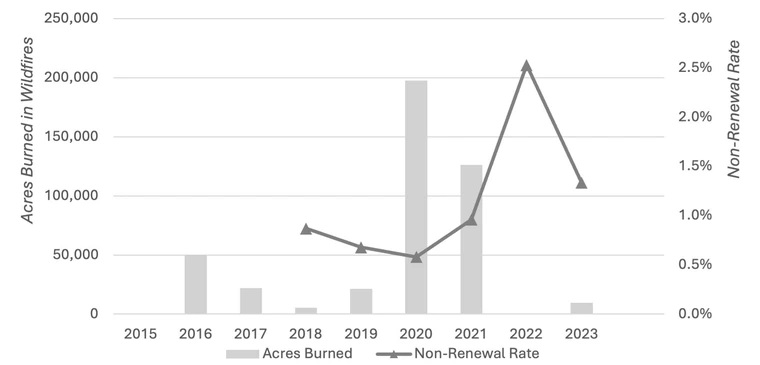

Generally, 2020 and 2021 were large fire years for Arizona, with statewide acreage burned near a million acres in 2020 and over 500,000 acres in 2021. Following these large fire years, we see an increase in non-renewals in select counties, with a one to two-year time lag (Figure 6).

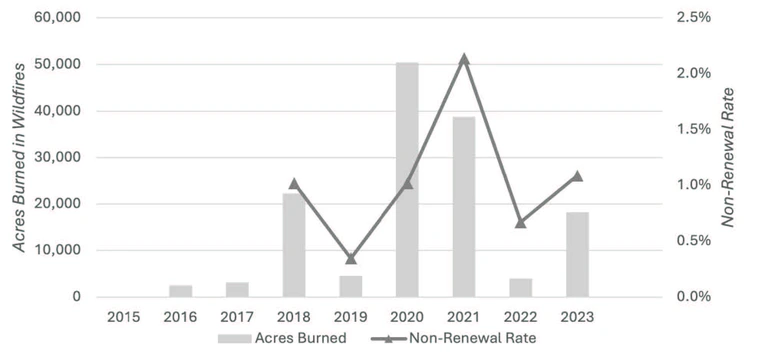

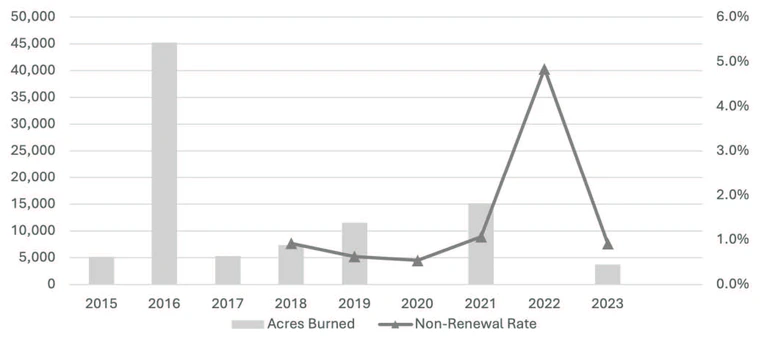

Figure 7 presents annual burned acreage estimates and annual county non-renewal rates for Gila County. Gila County has experienced a series of large fires in recent years. The county’s non-renewal rate closely mirrors burned acreage, with a roughly two-year lag.

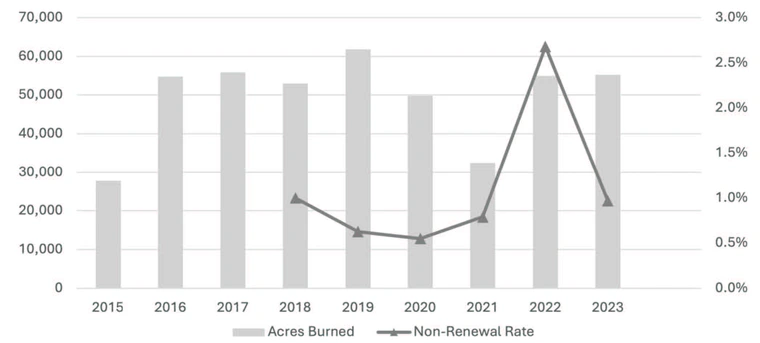

Though small in terms of population, Greenlee County includes many forested areas and has experienced large wildfires in the past. We see a spike in non-renewal rates following the 2020 and 2021 fire seasons (Figure 8).

Navajo County experienced a sharp increase in nonrenewal rates in 2022, though at a county-level it did not experience large fire seasons in 2020 and 2021 (Figure 9).

Coconino County is a county with high fire risk. It also saw a sharp increase in non-renewals following the 2020 and 2021 fire seasons (Figure 10).

Though these high-risk counties have seen sharp spikes in homeowners’ insurance non-renewals, most non-renewals occur in the state’s most populous counties. Over the period from 2018 to 2023, Maricopa County accounted for nearly 55% of reported non-renewals statewide, followed by Pima and Pinal counties (Table 2). This suggests that baseline levels of non-renewal may drive overall numbers of non-renewals, though on a per-policy basis, high-risk areas may experience non-renewal at higher rates.

Figure 4. Non-Renewal Rate by Arizona Zip Code by Percentile and Year, 2018-2022.

Figure 5. Scatterplot of Zip Code-Level Non-Renewal Rate vs. Average Acres Burned within 50 miles of Zip Code over 2 Previous Years.

Figure 6. Statewide Wildfire Acres Burned & County-Level Non-Renewal Rates, 2015-2024.

County | Percent of Non-Renewals |

|---|---|

MARICOPA | 54.9% |

PIMA | 14.6% |

PINAL | 8.2% |

YAVAPAI | 5.0% |

MOHAVE | 3.5% |

NAVAJO | 3.2% |

COCONINO | 2.7% |

YUMA | 2.3% |

COCHISE | 1.8% |

GILA | 1.6% |

SANTA CRUZ | 0.9% |

GRAHAM | 0.6% |

APACHE | 0.4% |

LA PAZ | 0.2% |

GREENLEE | 0.1% |

Discussion and conclusions

Homeowners’ insurance is an important tool for protecting household wealth and is usually required to obtain a mortgage. In response to changing risks associated with wildfire and other natural hazards, homeowners’ insurance providers have been making changes to their portfolios. This includes not renewing policies in areas considered as too risky. While by number, most homeowners’ insurance non-renewals occur in metropolitan areas of Arizona, there is a strong correlation between recent wildfire activity and non-renewals in certain areas of the state. This may represent challenges for housing access and affordability.

This bulletin presents recently released information on homeowners’ insurance non-renewals in Arizona. Though there are strong correlations between wildfire activity and non-renewals in certain areas of the state, the data does not provide information on the underlying reasons for non-renewal of the policies. The data, therefore, must be interpreted with caution. Nonetheless, the correlations point to a need for further information and cooperative action among individuals, communities, fire professionals, and state and federal government to address this rising concern.

References

Arizona Department of Insurance and Financial Institutions (2025). Frequently Asked Questions. Retrieved from https://difi.az.gov/homeownersinsurance-frequently-asked-questions

FEMA (2025). National Risk Index. Retrieved from https://hazards.fema.gov/nri/

NIFC (2025). National Interagency Coordination Center Annual Reports. National Interagency Fire Center. Retrieved from https://www.nifc.gov/nicc/predictive-services/intelligence

Senate Budget Committee (2024). New to Fall: The Climate-Driven Insurance Crisis is Here – And Getting Worse. Staff Report. Retrieved from https://www.budget.senate.gov/imo/media/doc/next_to_fall_the_climate-driven_insurance_crisis_is_here__and_getting_worse.pdf

U.S. Department of the Treasury (2025). Analyses of U.S. Homeowners Insurance Markets, 2018-2022: Climate-Related Risks and Other Factors. Federal Insurance Office, U.S. Department of the Treasury.

USGS MTBS (2025). Monitoring Trends in Burn Severity (MTBS) Database. Retrieved from https://mtbs.gov/direct-download